Tax Refund

At present, Beijing, Shanghai, Tianjin, Shenzhen, Qingdao, Jiangsu Province, Hebei Province, Shaanxi Province, Yunnan Province, Anhui Province, Sichuan Province, Liaoning Province, Fujian Province, Hainan Province as well as Harbin, Heihe, Suifenhe in Heilongjiang Province and Nanning, Guilin, Fangchenggang in Guangxi have adopted a tax refund policy among overseas, Hong Kong, Macau, and Taiwan tourists. Visitors who have bought products at tax free stores in China can withdraw value added tax (VAT) before leaving. It's expected that in the near future the policy will come into effect in more and more China regions.

1. Overseas/Hong Kong/Macau/Taiwan visitors should stay in Mainland China for no more than 183 days consecutively to qualify for the tax rebate policy.

1. Overseas/Hong Kong/Macau/Taiwan visitors should stay in Mainland China for no more than 183 days consecutively to qualify for the tax rebate policy.

2. The purchased goods should be for personal use and not prohibited to be taken out of Mainland China.

2. The purchased goods should be for personal use and not prohibited to be taken out of Mainland China.

See detailed Exit Regulations of China.

See detailed Exit Regulations of China.

3. A minimum of CNY 500 shall be spent in one designated tax free store during any one day by one tourist.

3. A minimum of CNY 500 shall be spent in one designated tax free store during any one day by one tourist.

4. The visitor shall exit from designated ports and ensure that the goods are brand new and unused. At present, the designated ports mainly include airports and cruise ports, like Beijing Capital International Airport, Shanghai Pudong International Airport, and Tianjin Binhai International Airport.

4. The visitor shall exit from designated ports and ensure that the goods are brand new and unused. At present, the designated ports mainly include airports and cruise ports, like Beijing Capital International Airport, Shanghai Pudong International Airport, and Tianjin Binhai International Airport.

5. The time span between the purchase date and the departure date shall be less than 90 days.

5. The time span between the purchase date and the departure date shall be less than 90 days.

6. The purchased goods must leave China along with the visitor.

6. The purchased goods must leave China along with the visitor.

Currently, there are over 200 designated tax free stores in Beijing, about 180 in Shanghai, 33 in Chengdu of Sichuan, 69 in Shenzhen, 34 in Tianjin, 33 in Qingdao, 10 in Xiamen of Fujian, 9 in Qinhuangdao of Hebei, 2 in Haikou and 3 in Sanya... They cover the major shopping malls, tourist shopping centers, and residence areas of foreigners. Here is a list of some:

In Beijing: Gongmei Group, Wangfujing Department Store, Dong'an Department Store, and Wuyutai Tea Shop on Wangfujing Street; Huayuan Shopping Center, Pacific Department Store, and Hanguang Shopping Mall on Xidan Commercial Street…

In Beijing: Gongmei Group, Wangfujing Department Store, Dong'an Department Store, and Wuyutai Tea Shop on Wangfujing Street; Huayuan Shopping Center, Pacific Department Store, and Hanguang Shopping Mall on Xidan Commercial Street…

In Shanghai: Shanghai New World Co., Ltd, Maochang Optical, and Heng Da Li Watch Flagship Store on Nanjing Road; Huabao Pavilion and Tianyu Pavilion around Yuyuan Garden…

In Shanghai: Shanghai New World Co., Ltd, Maochang Optical, and Heng Da Li Watch Flagship Store on Nanjing Road; Huabao Pavilion and Tianyu Pavilion around Yuyuan Garden…

In Xi'an: Kaiyuan Shopping Center, Parkson Shopping Center, Century Ginwa Shopping Plaza near the Bell Tower...

In Xi'an: Kaiyuan Shopping Center, Parkson Shopping Center, Century Ginwa Shopping Plaza near the Bell Tower...

In Tianjin: Yangliuqing Painting Store, Binjiang Shopping Center, Guorenzhang Nuts Store...

In Tianjin: Yangliuqing Painting Store, Binjiang Shopping Center, Guorenzhang Nuts Store...

In Chengdu of Sichuan: Renhe Spring Department Store, International Finance Square...

In Chengdu of Sichuan: Renhe Spring Department Store, International Finance Square...

In Haikou: S&S Department Store, Minsheng Department Store

In Haikou: S&S Department Store, Minsheng Department Store

In Sanya: Yifang Shopping Center, Sanya International Shopping Center, Summer Mall

In Sanya: Yifang Shopping Center, Sanya International Shopping Center, Summer Mall

The refund rate is 11% of the invoice value. However, 2% of the rebates are charged by the rebate agency as service fee. Therefore, visitors actually enjoy a rebate rate of 9%.

The refund rate is 11% of the invoice value. However, 2% of the rebates are charged by the rebate agency as service fee. Therefore, visitors actually enjoy a rebate rate of 9%.

Refunds = Invoice Value (VAT included) x Rebate Rate (11% - 2%)

For instance, if one spends CNY 1000 in a store, CNY 90 (CNY 1000 x 9%) will be returned.

The rebates will be given in CNY. If the amount is not beyond CNY 10,000, both cash and bank transfer rebates are allowed. Otherwise, if the amount exceeds CNY 10,000, only bank transfer is allowed.

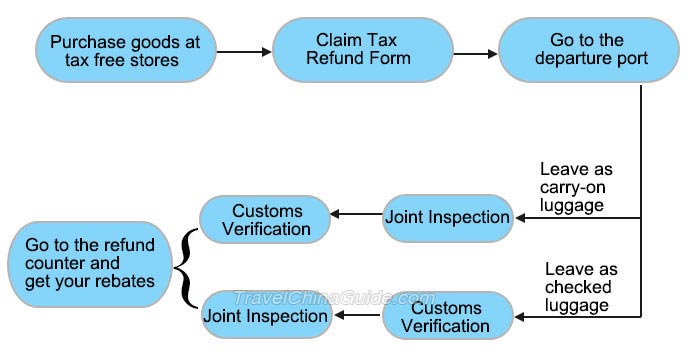

1. Purchase goods in designated stores with the "Tax Free" sign. Ask for the sales invoice and tax refund form from the clerk.

1. Purchase goods in designated stores with the "Tax Free" sign. Ask for the sales invoice and tax refund form from the clerk.

2. Visit the customs office at the departure port and present the refund form, invoice, passport or ID card as well as the purchased products. If nothing goes wrong, the officer will stamp on the refund form.

2. Visit the customs office at the departure port and present the refund form, invoice, passport or ID card as well as the purchased products. If nothing goes wrong, the officer will stamp on the refund form.

3. After, go through the joint inspection, head to the refund counter, have the materials examined and have the rebates back.

3. After, go through the joint inspection, head to the refund counter, have the materials examined and have the rebates back.

Note: Under the condition that all necessary materials are prepared, it takes three to five minutes at the customs office and refund desk respectively. On average, it takes a visitor about 15 minutes to go through all the formalities. However, it's strongly recommended to spare additional 40 minutes to an hour for the whole process.

Note: Under the condition that all necessary materials are prepared, it takes three to five minutes at the customs office and refund desk respectively. On average, it takes a visitor about 15 minutes to go through all the formalities. However, it's strongly recommended to spare additional 40 minutes to an hour for the whole process.

Location for Custom Verification and Refund at Main Exit Ports

Location for Custom Verification and Refund at Main Exit Ports

|

| Tax Refund Process |

Conditions for Using the Policy

Currently, there are over 200 designated tax free stores in Beijing, about 180 in Shanghai, 33 in Chengdu of Sichuan, 69 in Shenzhen, 34 in Tianjin, 33 in Qingdao, 10 in Xiamen of Fujian, 9 in Qinhuangdao of Hebei, 2 in Haikou and 3 in Sanya... They cover the major shopping malls, tourist shopping centers, and residence areas of foreigners. Here is a list of some:

|

|

Tax Refund Rate

Refunds = Invoice Value (VAT included) x Rebate Rate (11% - 2%)

For instance, if one spends CNY 1000 in a store, CNY 90 (CNY 1000 x 9%) will be returned.

The rebates will be given in CNY. If the amount is not beyond CNY 10,000, both cash and bank transfer rebates are allowed. Otherwise, if the amount exceeds CNY 10,000, only bank transfer is allowed.

How to Apply for Rebates

| Designated Exit Ports | Check Points of Customs | Location of Refund Counter |

|---|---|---|

| Beijing Capital International Airport | 2F, International Departure Zone, T2 Zone C, 2F, T3 (check-in items); Zone E, 2F, T3 (carry-on items) | T-mouth, 2F, International Departure Zone, T2; Zone E, 2F, T3 |

| Shanghai Pudong International Airport | Gate 10, International Departure Hall, T1; Gate 25, International Departure Hall, T2 | Separate Zone for international departures |

| Shanghai Hongqiao International Airport | Gate 6, International Departure Hall, T1 | Separate Zone for international departures |

| Shenzhen Bao'an International Airport | Customs Surveillance Zone, Departure Hall, Terminal T3 Floor 3 | See the signpost inside the Isolated Area of Terminal T3 |

| Chengdu Shuangliu International Airport | Left of International Entry/Exit Passage, International Departure Zone, T1 | Boarding Gate 102, International Departure Zone, T1 |

| Qingdao Liuting International Airport | Near the entrance of the Separate Zone for international departures (check-in items); Boarding Gate 8, Separate Zone for international departures (carry-on items) | Boarding Gate 8, Separate Zone for international departures |

| Tianjin Binhai International Airport | International Departure Hall, T1 | Separate Zone for international departures |

- Last updated on May. 17, 2023 -

Questions & Answers on Tax Refund

Asked by Lee Boon Kai from SINGAPORE | Jun. 29, 2023 01:46 Reply

Reply

Tax Refund

What is the email address I can use to contact Pudong airport T2 for Tax Refund issue and status?

Answers (1)

Answered by Hally | Jun. 29, 2023 19:47 0

0 0

0 Reply

Reply

Sorry I didn't find the email address. This is their phont: 021-61767971. Hope it helpful.

Asked by jess from SINGAPORE | May. 17, 2023 04:19 Reply

Reply

if my friend is a china citizen and helps me purchase something b4 returning to singapore,

is she eligible for tax rebate

Answers (1)

Answered by George | May. 17, 2023 19:39 0

0 0

0 Reply

Reply

I'm afraid she can not. It is only eligible for foreigners and people from HK, Taiwan, and Macau.

Asked by Oyundelger from MONGOLIA | May. 12, 2023 05:58 Reply

Reply

Tax refund

Hi, i am leaving China from Erlian port in few days. Can i go to Beijing capital airport to claim my tax refund while i am in Beijing? Thank you in advance!

Answers (1)

Answered by Jenny | May. 14, 2023 22:54 0

0 0

0 Reply

Reply

If you don't plan to leave from Beijing Capital airport, then I'm afraid you cannot claim it there.

Asked by Akshit from INDIA | Jan. 07, 2020 04:09 Reply

Reply

I am Planning to buy MacBook Pro at Apple Store in Shenzhen can I clain refund on HK airport

I am Planning to buy MacBook Pro at Apple Store in Shenzhen can I clain refund on HK airport or Shekou ferry terminal. ?

Answers (2)

Answered by Angela from USA | Jan. 07, 2020 17:22 0

0 0

0 Reply

Reply

No, I am afraid not.

Answered by Akshit from INDIA | Jan. 08, 2020 03:14 0

0 0

0 Reply

Reply

IS there any way we can buy electronic stuffs on Apple brand stores in Shenzhen and claim VAT refund.

What all items are covered under tax refund.

What all items are covered under tax refund.